Any organization or committee that functions under its trustees are required to file income tax return under ITR 7. Companies file income tax returns under ITR 6. ITR 5 is for those who are corresponding returns for firms and LLPs.ITR 4 which is known as “sugam” is for SMEs or small business professionals.ITR 3 is for individuals and HUFs which stands for Hindu Undivided Family with income generated from businesses.ITR 2 is for those who earn 50 or more than 50 lakh in non business transactions.ITR 1 which is known as “sahaj” is for those who receive salary at the end of each month.There are seven different categories of ITR that specify seven different categories of taxpayers. In the last couple of years there have been many amendments that have been introduced in ITR 1 and ITR 2. It is filled to cater information regarding the income and payable tax amount for a particular financial year between 1st april to 31st march of the next financial year. There are various forms such as ITR 1, ITR 2, ITR 3, ITR 4, ITR 4, ITR 5, ITR 6 and ITR 7 which are required to be filled. The returns should be filed within a specific due date assigned by the income tax department. Under the income tax act of 1961, and income tax rule of 1962, it obligates each citizen to file a return at the end of each financial year.

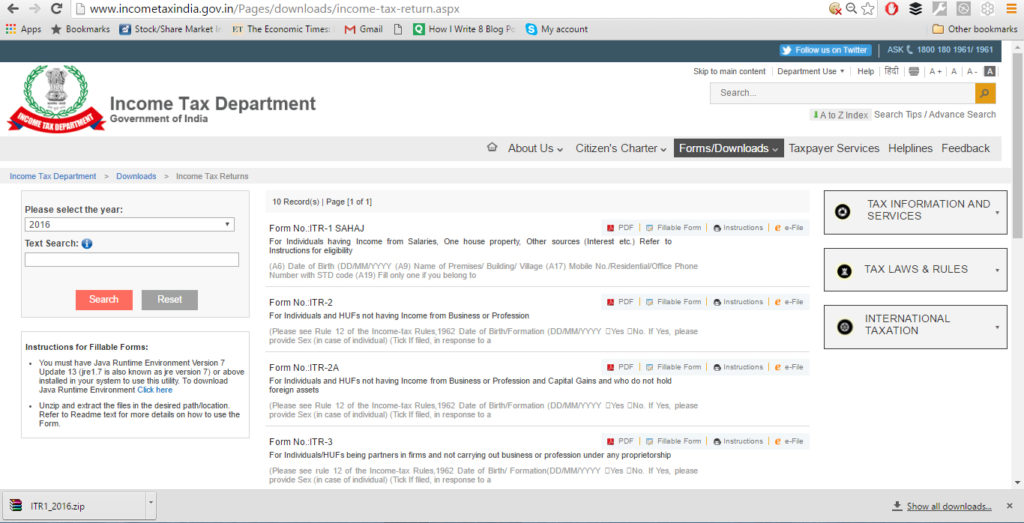

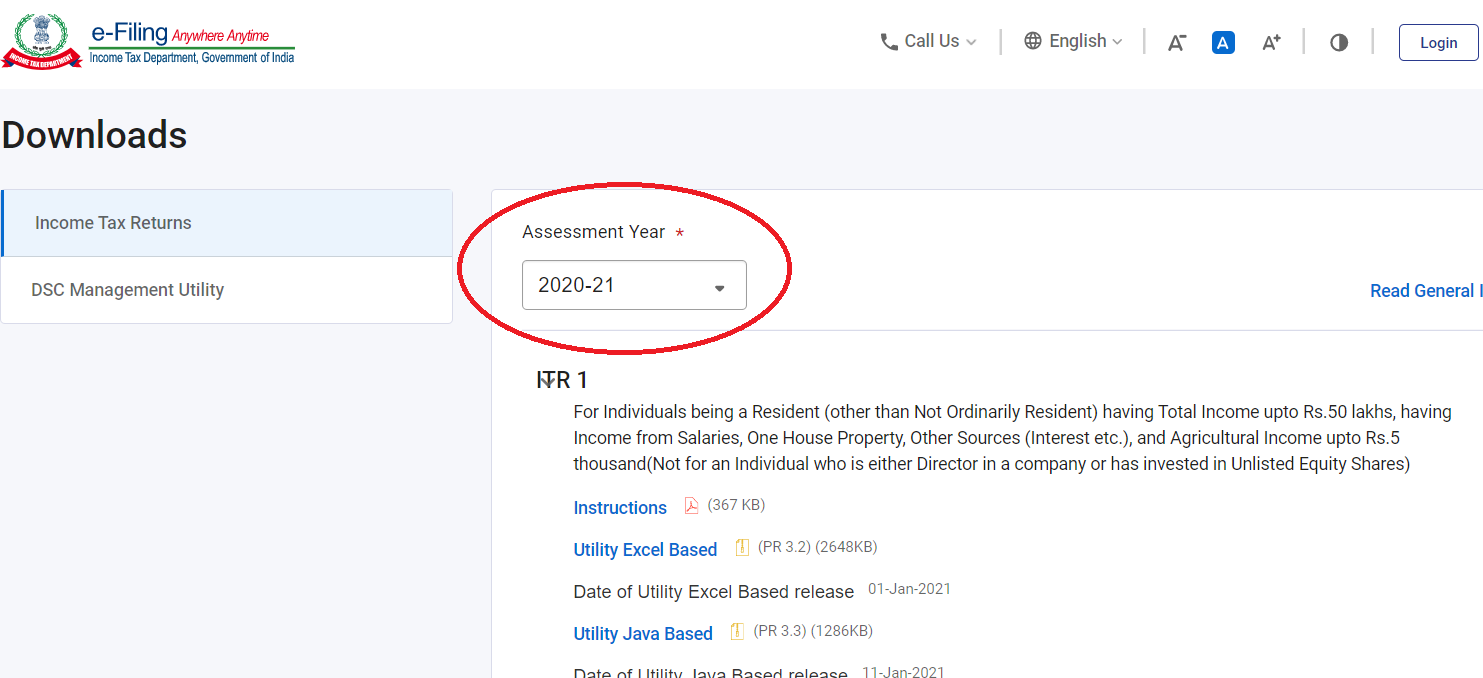

ITR as mentioned earlier is an abbreviation of income tax return. Upload the XML file on the income tax portal.Fill your details in the downloaded form.Download ITR utility form from income tax portal.

0 kommentar(er)

0 kommentar(er)